- ▶Revenue of KRW 2.3837 trillion and operating income of KRW 311 billion in Q3

- - 6% decrease in revenue and 32% decrease in operating income compared to the corresponding period of last year (Q3 2021)

- - 3% decrease in revenue and 14% decrease in operating income compared to the previous quarter (Q2 2022)

- - MLCC sales dropped due to slowing demand for IT sets such as smartphones and PCs and parts inventory adjustment

- ▶In Q4, uncertainty in demand for IT parts is expected to continue due to year-end inventory adjustments

- - To expand the supply of high-value-added MLCCs such as ultra-small and ultra-high-capacity products for IT and automobiles

- - To expand the supply of automotive camera modules and diversify suppliers, such as mass production of FCBGA for servers

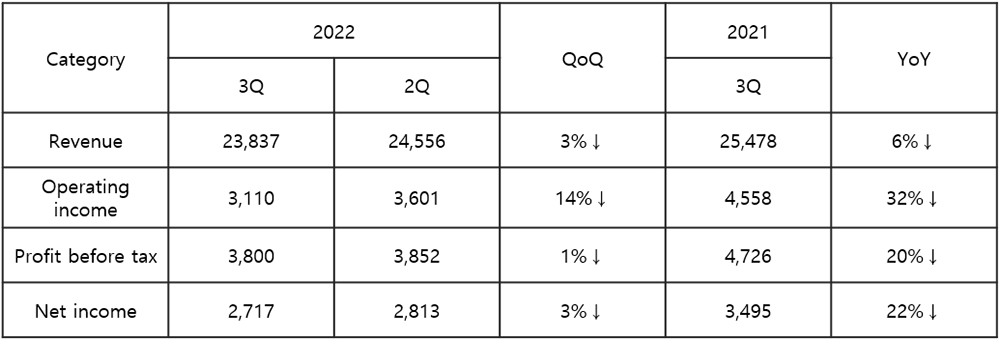

Samsung Electro-Mechanics posted revenue of KRW 2.3837 trillion and operating income of KRW 311 billion on a consolidated basis in the third quarter of 2022.

This marks YoY decreases of KRW 164.1 billion (6%) in revenue and KRW 144.8 billion (32%) in operating income, and QoQ decreases of KRW 71.9 billion (3%) in revenue and KRW 49.1 billion (14%) in operating income.

In the third quarter, sales of components such as high-pixel camera modules and automotive MLCCs increased on the back of the growth of the automotive market, but earnings fell QoQ due to reduced demand for IT sets such as smartphones and PCs and the effect of inventory adjustments.

In Q4, market demand recovery is uncertain due to the continued slowdown in demand for IT sets and the effect of the year-end off-season. Samsung Electro-Mechanics plans to respond by diversifying its suppliers, focusing on core growth businesses such as servers and electronics.

Earnings by Quarter

(Unit: KRW 100M)

Earnings and Forecast by Business Unit

The Component Unit's Q3 revenue was KRW 929.8 billion, down 30% YoY and 18% QoQ due to sluggish IT set demand and the effect of parts inventory adjustment. Sales of automotive products increased thanks to diversification of customers and expansion of supply of high value-added products.

In Q4, IT parts demand is expected to remain uncertain, but automotive market demand is forecast to stay robust. Samsung Electro-Mechanics plans to respond to the market demand for IT by focusing on ultra-small and ultra-high-capacity products for smartphones, while expanding the supply of high-reliability automotive MLCC products such as high-temperature and high-pressure products.

The Optics & Communication Solution Unit recorded KRW 901.4 billion in revenue, up 14% YoY and 16% QoQ, thanks to increased supply of high-performance camera modules for flagship smartphones and high-reliability automotive camera modules for major Korean and overseas partners.

Demand is expected to weaken in the fourth quarter due to the year-end off-season. Samsung Electro-Mechanics will respond in a timely manner to high-pixel camera modules for new flagship smartphones and expand the supply of high-pixel camera modules for automobiles.

The Package Solution Unit posted Q3 revenue of KRW 552.5 billion, up 26% YoY and 3% QoQ thanks to increased supply of 5G/network/automotive package substrates.

In Q4, demand for some IT products is expected to weaken, but demand for high value-added semiconductor package substrates such as servers, networks, and electronics is forecast to continue to grow. In particular, the company will work to lay the foundation for sales growth by mass-producing FCBGA for servers and expanding the supply of network and automotive substrate products.

Revenue by Business Unit

(Unit: KRW 100M)